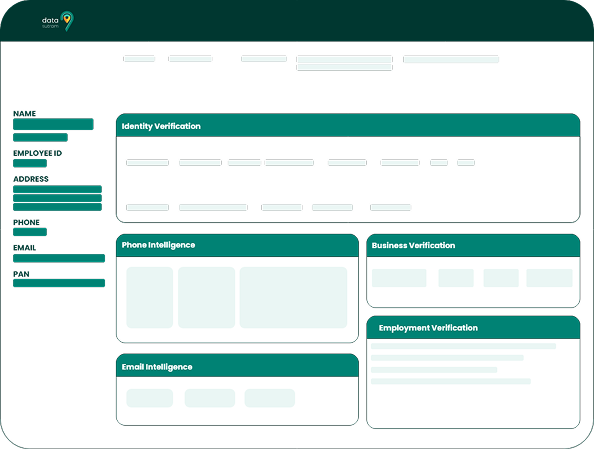

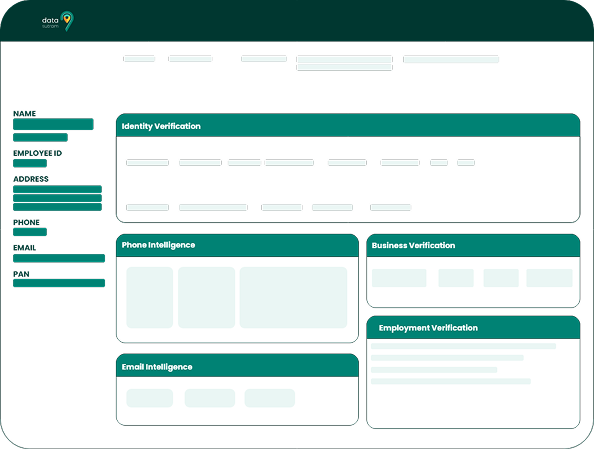

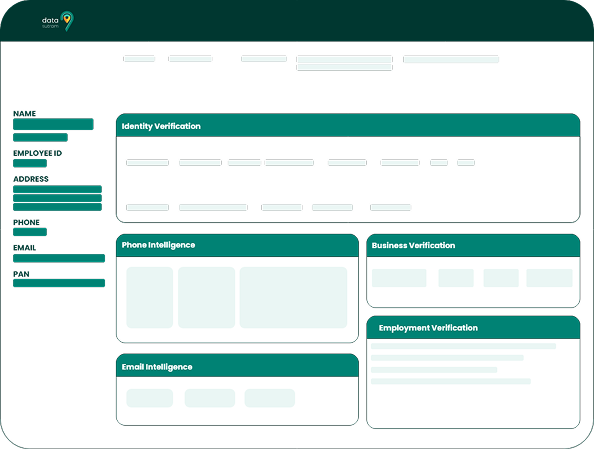

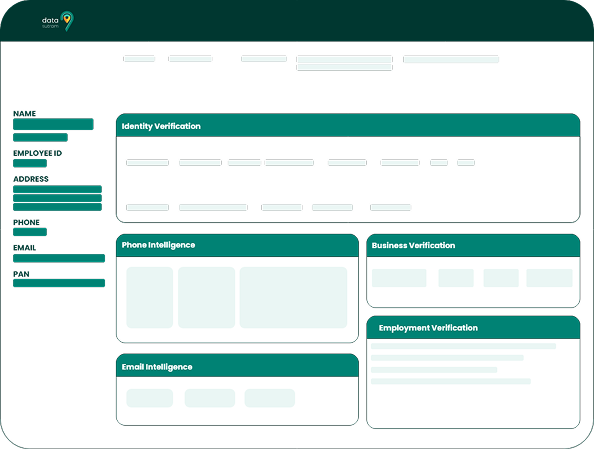

Accelerate decision-making with precision. From strengthening fraud detection and streamlining KYC to optimizing collections and unlocking new growth opportunities, our intelligence-driven solutions enable banks and NBFCs to act faster, smarter, and with greater confidence.

© 2025 Copyright: Extrapolate Advisors Pvt. Ltd | ISO 27001:2013 Certified | Privacy Policy | Disability Act.